Who has Best and Lowest Cash-Out Refinance Rates?

Commentary: "Who has the best cash out refinance rates?" With so many lenders, it is nearly impossible to easily identify the lowest rate cash out refinance. Because rates change, we will share a tool you can use to effortlessly identify best rates.

What's the cost savings of finding the lowest cash out rates?

The difference between 3.25% and 3.75% on 30 year fixed rate loan of $300,000.00 is a whopping $32,040.00 in savings that we loose by not finding the right lender. So what if you were refinancing for $30,000.00 cash out? In this case, by finding the best rate lender compared to average, means your cash out is relatively free.

Now, that you have a real world mathematical understanding of the advantage of capturing the best & lowest cash out refinance rate, lets talk about how to simplify the search for the best with minimal effort an no sales pressure, lead traps, teaser rates, spam calls or emails and 100% private to use.

Where to find the best lowest rate cash out refinance?

With so many mortgage lenders and interest rates changing daily, it would be very helpful to have in all in one real rate loan comparison tool, right? A tool, that is free to use, 100% private, with real interest rates updated daily, that effortlessly captures your maximum savings.

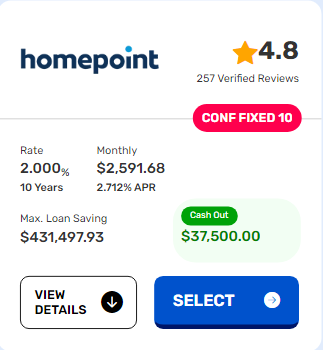

We have carefully selected the Nation's lowest interest rate cash out lenders and their rates are updated daily.

Finding the lowest and best cash out rates is now as easy as searching for lowest fare airline tickets.

Which lenders have the best lowest cash out refi rates?

Mortgage lenders change their interest rates daily & based upon how much business they have. If a mortgage lender is over loaded in refinance mortgage loans, they will raise their interest rates, even when rates have dropped.

- Home Point Financial: Conventional loan programs

- Loan Depot Mortgage: Conventional loan programs

- AmeriSave Mortgage: Conventional & FHA, VA

- Penny Mac Mortgage: FHA, VA, USDA best rates

- Plaza Home Mortgage: FHA/VA & Conventional

We are constantly monitoring lenders rates. From our research, the majority of best interest rates, loan programs are with the these mortgage lenders.

How can I see the lowest rate on cash out refi?

To see real cash out loan refinance rates, closing cost and monthly payments from the nations best rate lenders with out any credit pulls, just use this Cash Out Refinance Rate Tool. It only takes, about 3 minutes to complete, and you will have instant access to easily identify the lowest rates for cash out loans.

- We do not sell or share your information

- Only have to provide basic information

- Instantly see lowest cash out rates

- Available cash out and more

You will be surprised by the results. Using the full power of computers, not only are you getting the lowest rate from national lenders, the rates you will see are even lower because we use automation compared to people and this savings is passed back to you.

How does a cash out refinance work?

A Cash Out refinance is a mortgage loan, where you can elect to access a portion of the equity that is in your home. Equity is the difference from what you currently owe on your home and the present value of your house. For example, if your home is worth $100,000.00 and you only owe $75,000.00, then your Equity is $25,000.00.

In this case, the lender can provide a loan by not only paying off your current mortgage but also increase the loan amount so you are able to get cash back at closing. As stated in the above example, if the bank gave you a new loan for $100,000.00 - (minus) $75,000.00 to pay off your existing mortgage = $25,000 would be the cash proceeds available to you at closing.

What's the requirements for approval on cash out refi?

The general requirements for a cash out refinance mortgage loan are as follows:

- Minimum credit score of 580

- 2 years of employment or self employment history

- Must owe less than 80% the value of your home (unless Veteran)

- No Bankruptcy in last 2 years

- Satisfactory condition of home

- Gross Monthly Income is double your monthly bills

What is the closing cost on cash out refi?

Closing cost very from lender to lender. This is why it is beneficial to use a cash out refinance rate tool that immediately identifies lender by lender their closing cost. A general idea of closing cost are as follows:

- Origination Fee: 0-2% of loan amount *

- Discount points: 0-1% of loan amount *

- Application fee: $0-500.00 *

- Credit report fee: $35.00

- Home Appraisal: $500.00

- Title Insurance & services: $1,750.00

- Pre-Paid taxes and Insurance: TBD

** The origination fee, discount points, and application fee in many cases are $0.00. It depends on which lender is pricing your loan request. In our cash out rate tool, the results returned identify not only the lowest interest rate but also the lowest closing cost.

IMPORTANT: The easiest way to find the best loan is by looking at the Annual Percentage Rate (APR). The APR factors in all the finance charges plus the interest rate and generates a final value, that you can use from lender to lender to see who is giving you the best deal.

What Loan programs offer cash out refinance?

1. FHA Cash Out refi

- Min. 580 credit Score

- No Bankruptcy in last 3 years

- Max Cash Out 80% value of home

- 0 30 days late in last 12 months mortgage

- Requires monthly mortgage insurance

- FHA 1.75% Up Front MIP charge

2. VA Cash Out refi

- Min 580 Credit Score

- No Bankruptcy in last 2 years

- Max Cash Out 100% value of home

- 1 x 30 days late last 12 months

- No monthly mortgage insurance

- VA Funding fee 3.6% unless disabled

3. Conventional Cash Out refi

- Min 620 Credit Score

- No Bankruptcy in last 4 years

- Max Cash Out 80% value of home

- 0 x 30 days late last 12 months

- No monthly mortgage insurance

4. Jumbo Cash Out refi

- Min 660 Credit Score

- No Bankruptcy in last 4 years

- Max Cash Out 85% value of home

- 0 x 30 days late last 12 months

- No monthly mortgage insurance

Are there any out of pocket expense to do a cash out loan?

You will skip 2 months payments, when proceeding forward. The only out of pocket expense would be a real estate appraisal which averages $ 500.00.

Should I use a Home Equity loan or Cash Out Refi?

Almost if not all Home Equity Lines of Credit require a minimum credit score of 720. Home equity lines of credit use adjustable rates. Given that interest rates are rising, if you use a home equity line of credit, be prepared to refinance in the future when they raise rates on the line of credit.

The problem we see all the time, is when homeowners use equity lines of credit usually they are wanting to refinance to pay off the line of credit because the interest rate is not fixed and the payment increases and is not affordable.

Based upon current market conditions, it looks more beneficial to consider a cash out refinance instead of home equity line of credit.

Should I cash out equity to pay bills?

It depends on the amount of debt you want to pay off. For example, if you owe $10,000.00 or more on other debts that are consuming your paycheck, we would recommend you select debt consolidation on our cash out tool. This will do a complete savings analysis on your current debt load and will generate summary report of net savings.

In many cases, we see homeowners lower their monthly bills, and also pay off their homes faster with a debt consolidation loan.

What are the benefits of doing a cash out refinance?

- Use cash out for home repairs or remodels

- Offers the lowest interest rates compared to non-secured loans

- Interest is tax deductible

- Home values continue to replace the equity you withdraw

- Pay off debts and save thousands a month

- Pay your home off faster by being debt free

Do cash out mortgages have higher interest rates?

It depends on the loan program. See below:

1. FHA: cash out rates are same as purchase loan rates.

2. VA: cash out rates are same as purchase loans rates.

3. Conventional: Cash out rates are slightly higher, but there is no FHA 1.75% or VA 3.6% government funding fee.

What is the best loan program to use for cash out refinance?

The good news our automation will instantly calculate all scenarios and place the winner at the top of the list. However, here is a cheat sheet.

1. If Veteran, and disabled or is veteran and credit score is 580-660, in most cases VA is the winner.

2. FHA, if not a veteran and credit score is 580-660 range, in most cases FHA is winner.

3. Conventional, when credit score is 650-800 range, in most cases conventional is winner.

4. Jumbo Loans, offer excellent rates for cash out when your home value is above $700,000.00

Where can I go to get Instant Rate Comparison from best rate lenders?

We have created a multi lender rate and closing cost scanner that is updated daily. Within 3 minutes, no credit info required you will get the lowest rate guaranteed.

What is the most cash out I can get?

On Conventional and FHA loans you can get up to 80% the value of your home. If you are a veteran you can borrow up to 100% the value of your home. Simply take your home value and multiply it by 80%. Then subtract the amount you owe on your current loan.

What is the minimum credit score required for cash out loans?

580 is the minimum credit score required for these loans. However, we do have special programs that can go below 580. If you have less than 580 please call.

How can I lower my interest rate and get cash out on refi?

There is a good chance you can, if you have not refinanced in the last 2-3 years. It depends on your current interest rate. In many cases, by using the cash you receive to pay debts you will lower your payments.

With lower payments you can make extra principal payments and pay off home much faster.

Will the lender pay all closing cost on cash out refi?

Yes this is available. It is important to understand when lenders offer to pay closing cost, they are simply giving you a higher interest rate. This only makes sense when you are going to only have the new mortgage for less than 5 years on average.

Should I pay discount points for lower interest rates?

In most cases, if you know you will keep the loan and or home for more than 7 years, then yes. However, if you are confident you will sell or refinance before than chances are you will not recover the cost of buy down to enjoy the rewards of lower payments each month.

Should I call these banks or use this service here for cash out refi?

Because we do all the work, the same banks listed provide us with below retail interest rates. Think like Sams Wholesale. We originate, underwrite and close and fund the loan with the lowest interest rate you select. No fees, and the bank pays us to do the work.

This is how we guarantee the lowest interest rate & fee mortgage loans

How can I see Today's Cash Out Refinance Rates?

Simply use our cash out refi tool. Here you can instantly compare and see the lowest rates, not from one lender but all lenders in our system. You will be amazed.