LendingTree Mortgage Review 2023

Commentary: Researching to find the best source to shop for a mortgage is well worthy of praise. Our opinions are based upon 22 years of financial service experience. Having worked with 1000's of clients, we will provide you with a summary of what you can expect.

If your like me than you understand or have a general idea of the money you loose by not getting the lowest interest rate fee mortgage loan. Here is a link where you can see the average loss by not getting best deal is $ 32,040 in closing cost and higher rates.

LendingTree Mortgage Review for 2023: What you should know?

While LendingTree has done very well over the years, there are some time saving tips of information that you should be well aware of to help you find the right results you justly seek in being a good steward of managing your finances.

Does LendingTree sell my information?

Yes, they do. Based upon the LendingTree mortgage review 2022, and our research, this is a service that many mortgage lenders subscribe to in order to purchase users application information from LendingTree.

In other words, consumers follow the advertising directions that they can shop and compare interest rates from the nations best lenders, then LendingTree sells their data to many mortgage lenders who begin sending emails and multiple phone calls.

Note: If you are looking for a real Full Service Digital Mortgage Market Place, where our automation will match your profile to the real lowest interest rate and fee mortgage loan in our market without anyone selling or sharing your information please know, we offer the Lowest Interest Rate Fee Guarantee.

We do not charge any fees and are compensated by the winning lender to originate, process, close and fund your loan.

You can access our digital mortgage market place and search today's lowest rate lenders in our system by going to APPLY NOW.

Does LendingTree show me real accurate mortgage interest rate quotes based on my profile?

Unfortunately no. At the time of this article we checked, they do not have this ability to do so. Mortgage interest rates are based off of your known credit score. LendingTree online mortgage application only ask for your credit score in a range, therefore the LendingTree rates they will show you are generalized and not personalized to you.

In order to get accurate real loan terms from multiple lenders you will have to make a full credit grade application with each lender to compare mortgage rates and loan offers.

Does LendingTree find the lowest interest rates mortgage lenders to make sure I can see their interest rates?

No, we do not believe that is part of their business model. Their business model is based on selling your information to mortgage lenders that want to purchase your information. The lenders that subscribe to this paid service, will often advertise teaser interest rates.

How many companies does LendingTree sell my information?

The last we checked, we are under the impression they will sell your information to at least 4 different mortgage companies.

Our over all understanding from clients we helped that had previously applied on LendingTree, was that the service was void of real rate offers and the clients were very frustrated with endless supply of unwanted phone calls.

Does LendingTree originate, underwrite and fund mortgage loans?

No LendingTree is not a mortgage lender. They only collect your general information, which is too basic to provide accurate mortgage loan quotes and estimates, to mortgage lenders of all shapes and sizes.

Does LendingTree screen the mortgage companies they sell my information too?

Yes, by law soliciting a mortgage application is against the law unless the company is licensed to originate mortgage loans. therefore, at a minimum they must verify the company has a valid mortgage license.

What have past customers reviews of LendingTree said?

Most all of the clients that we have spoken to during or after applying with LendingTree have been very vocal on their frustrations about non stop spam phone calls and emails.

Will using LendingTree help me get a lower interest rate?

Yes, it can help you. It really depends on what interest rates the banks have that bought your information from LendingTree. However, to affectively shop your loan for best mortgage terms, you will have to make multiple full credit grade mortgage loan applications.

Is there an easier way to find the lowest interest rate fee mortgage loan the market without all this hassle?

Yes, EquiFund Mortgage provides the first in class Full Service Digital Mortgage Market Place, that allows you to compare REAL interest rates and closing cost from the Nations lowest rate mortgage lenders.

We actually originate close and fund your mortgage with the winning lender with no origination fees. The mortgage lender pays us much like they pay their employees to do the work.

It only takes about 3 minutes and you will be able to instantly see real interest rates. COMPARE RATES HERE

What does the LendingTree Mortgage Review say online?

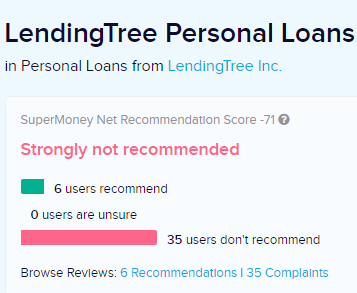

The LendingTree mortgage reviews we find online unfortunately what we expect to see based on this business model. below is a screen shot taken at time of this article from supermoney.com.

Are LendingTree Rates Real?

No, we explain all of this by clicking the hyperlink in blue right above. The rates provided by Lending Tree are generalized, because their online application form is too short and does not ask all the questions needed to provide a real accurate rate quote. In general, these rate quotes are teaser rates intended to motivate the user to complete the sign up form.

LendingTree vs EquiFund Mortgage Comparison

Because, EquiFund Mortgage ask all the necessary questions, applicants receive accurate rate quotes compared to Lending Tree. In addition, unlike LendingTree selling user information to any mortgage broker or lender willing to pay for the data, EquiFund Mortgage will not sell or share the users information.

Unlike Lending Tree, EquiFund Mortgage actually closes and funds the mortgage loan with the lowest interest rate lender you select. Therefore, there are no additional contacts needed. Whereas, LendingTree sends your information to multiple mortgage lenders and mortgage brokers and the phone calls begin.

By virtue, of consumer privacy, and accuracy of loan shopping results, and Equifund Mortgage actually closes and funds the loan. We see EquiFund as the better full service digital mortgage market place.

What type of loans are available on EquiFund Mortgage's full service Digital Mortgage Market Place?

EquiFund has a large variety of mortgage products and loan options that will automatically be processed to your profile. We have special FHA VA mortgage programs that have no credit score requirements, as well as adjustable rate mortgages, fixed rates, for all terms 15,, 20 and 30 year terms. Here is a general list of loan options and programs available.

- FHA Loans Special Program (no credit score required)

- VA Special Program (no credit score required)

- FHA Standard

- VA Loan Standard

- VA Loan 100% Financing

- Conventional

- USDA Rural 100% Financing

- Jumbo Mortgage Loans

Do I have to provide my social security number in order to see these loan options?

No, almost everyone we know knows there credit score, so simply enter your last known credit score for an accurate loan pre-approval and you will see all programs that you qualify for without phone calls and emails. This service is 100% private to use.

Will EquiFund Mortgage sell or share my information?

No, we do not sell or shar your information. If you elect to accept the lowest interest rate mortgage offer, your information will be forward inside our business to a loan officer who will be your sole point of contact till closing.

Does EquiFund charge any fees for this service?

We do not use the old business model of commissions paid to loan officers. This type of compensation may impact your ability to get the lowest rates.

Because we do not pay costly commissions, we will pass this savings back to you by getting an even lower interest rate than normal.

EquiFund Mortgage is paid directly by the winning mortgage lender. There are no origination fees, underwriting fees or processing fees.

Are you licensed through the Department of Veteran Affairs?

Yes, we have a VA Mortgage Lender ID, and have been in good standing since 2002. We have over 22 years of Veteran Administration loan originations. If you are a veteran and in need of a VA Loan, we would encourage you to explore all the available and private loan offers on our APPLY NOW link.

Do you have a Better Business Bureau Rating?

Yes, we are proud to say that we have maintained an A+ Better Business Bureau Rating since 1998.